When you're shopping for a brand-new vehicle, the new car invoice price is one of the most crucial pieces of information you can have. Yet, many consumers don't fully understand what the new car invoice price is, how it influences your negotiations, and how you can leverage it to get the most competitive deal possible.

In this comprehensive guide, we will explain everything you need to know about the new car invoice price, including how to find it, how it compares to the MSRP, and how you can leverage it when buying a brand-new car.

Understanding the New Car Invoice Price

The new car invoice price is the amount a dealership pays the manufacturer for a vehicle. Think of it as the "wholesale price" of a car. It usually appears lower than the MSRP, which is the manufacturer's suggested retail price.

But, the new car invoice price doesn't always tell the whole story. Dealers often receive bonuses and discounts that lower their actual cost even further. So, while the new car invoice price is crucial, it is not necessarily the final figure for the dealer.

Comparing New Car Invoice Price and MSRP

Understanding the difference between the new car invoice price and the MSRP is critical:

MSRP (Manufacturer's Suggested Retail Price): The price the automaker recommends the dealer sell the car for.

New car invoice price: The price the dealer technically pays the automaker for the car.

Typically, the MSRP is much higher than the new car invoice price, allowing room for bargaining.

Buyers who only focus on MSRP without considering the new car invoice price often overpay.

Why Dealers Mention the New Car Invoice Price

Dealers carefully use the new car invoice price to suggest of a better deal. They'll often present that you're getting a vehicle "close to invoice," implying they aren't making much profit.

In reality, manufacturer rebates, bonuses, and holdbacks mean they could still earn a big margin above the new car invoice price.

Where to Locate the New Car Invoice Price

Finding the new car invoice price was once a challenge, but now several websites offer easy access:

Edmunds: A trusted source for invoice prices.

Kelley Blue Book (KBB): Provides invoice prices alongside fair market values.

Consumer Reports: Offers in-depth pricing reports, including invoice figures.

When you research the new car invoice price, ensure you’re looking at the specific model, model, trim level, and options package to get an accurate number.

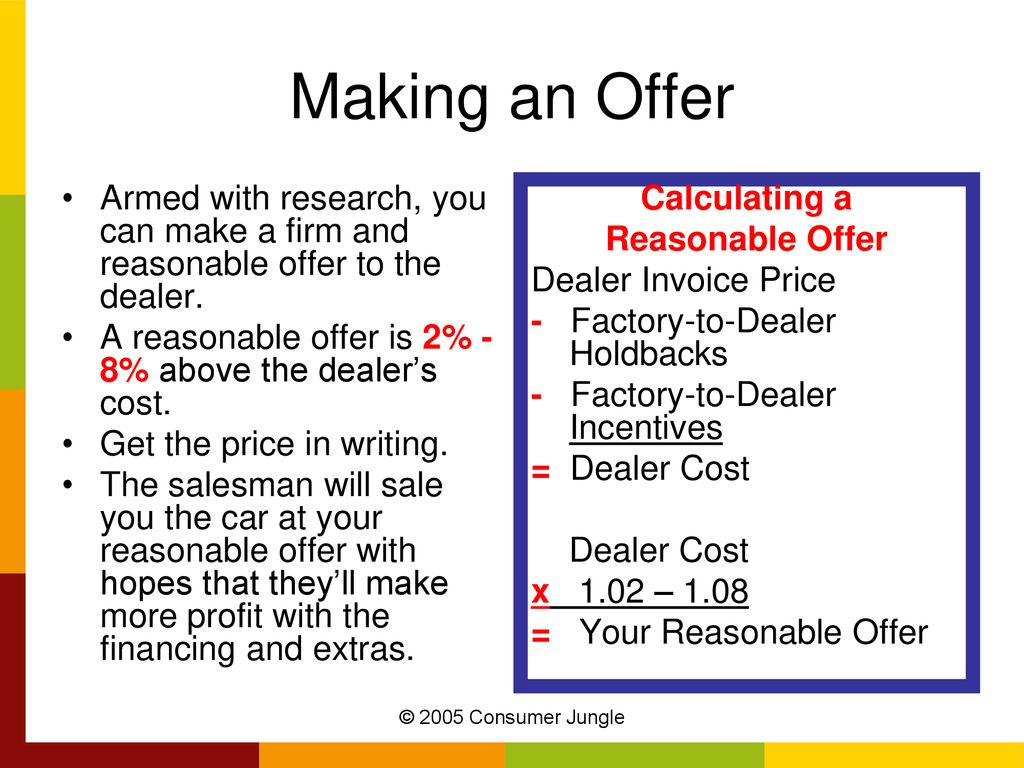

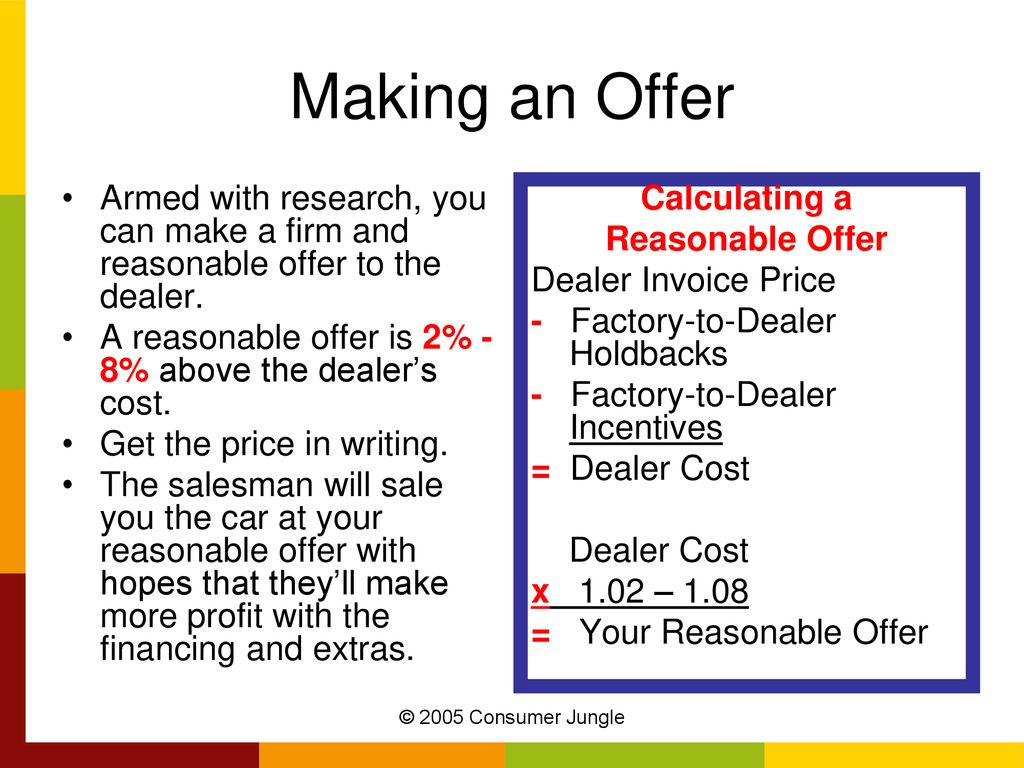

Dealer Incentives and the Hidden Discounts Behind the New Car Invoice Price

You might think the dealer’s cost is simply the new car invoice price, but it’s often even lower after factoring in:

Dealer Holdbacks: A percentage of the MSRP or invoice price paid back to the dealer after the sale.

Dealer Incentives: Cash bonuses offered by manufacturers for selling certain models.

Volume Bonuses: Rewards for selling a certain number of units in a given time period.

This means even if you pay slightly above the new car invoice price, the dealership could still profit nicely.

Winning Car Deals with New Car Invoice Price Knowledge

Here’s how you can apply the new car invoice price when negotiating:

Start with the Invoice: Base your offer on the new car invoice price, not the MSRP.

Add a Fair Profit: Dealers deserve to make some money; $500–$1,000 over invoice is considered fair.

Negotiate Up, Not Down: Instead of starting from MSRP and negotiating down, start from the new car invoice price and work up.

Knowledge of the new car invoice price gives you a logical, fact-based platform for discussions.

Common Myths About the New Car Invoice Price

There are many misconceptions about the new car invoice price, including:

Myth 1: Dealers lose money selling at invoice. (Not true; they have other sources of profit.)

Myth 2: Invoice pricing is always fair. (Sometimes, there are huge hidden margins.)

Myth 3: You can’t negotiate below the new car invoice price. (

how to find the new car invoice price can!)

Should You Always Pay Close to the New Car Invoice Price?

Not necessarily. While paying near the new car invoice price is a solid goal, market conditions affect pricing.

If the car is in high popularity, you might have to pay above invoice. If it’s plentiful, you could negotiate a deal far below the new car invoice price.

Finding New Car Invoice Prices Online

The best tools for uncovering the new car invoice price include:

TrueCar

NADA Guides

CarGurus

These platforms help you see real-world pricing trends beyond just the new car invoice price.

How the New Car Invoice Price Saved Thousands

Imagine a buyer who found a 2024 Toyota Camry with a $30,000 MSRP and a new car invoice price of $27,000.

After knowing the new car invoice price, they negotiated the final purchase to $27,500.

If they had started from the MSRP and negotiated down, they might have only gotten $29,000.

Knowledge of the new car invoice price saved them $1,500 to $2,000 instantly.

Tips for Negotiating Below the New Car Invoice Price

Yes, it’s possible. Here's how:

End-of-Month Shopping: Dealers are more desperate to hit sales targets.

End-of-Year Clearance Sales: Best time for deals below the new car invoice price.

Multiple Quotes: Get invoice quotes from several dealers and play them against each other.

Negotiating below the new car invoice price requires persistence, timing, and information.

How Dealers Play Games With the New Car Invoice Price

Be aware of these dealer tricks:

Focusing on Monthly Payments: Diverts attention from the total new car invoice price.

Adding Fake Fees: Watch for unnecessary charges added after you agree to a price.

Invoice Padding: Sometimes dealers artificially inflate the "invoice price" by adding overpriced accessories.

Understanding the real new car invoice price protects you from these tactics.

Electric Car Invoice Prices Explained

The EV market adds complexity to the new car invoice price:

Government Incentives: Rebates and tax credits can affect final costs.

Higher Demand: New electric vehicles often sell at or above MSRP.

Hidden Dealer Incentives: Still exist for EVs, even if supply is tighter.

Knowing the new car invoice price is just as important — maybe even more important — when buying electric vehicles.

Summary: Why the New Car Invoice Price Matters

Knowledge is power when buying a car. Understanding the new car invoice price gives you a massive advantage in negotiations, helping you save thousands of dollars.

By using trusted websites, knowing about dealer incentives, and being ready to walk away if the deal isn’t right, you can use the new car invoice price as your strongest bargaining chip.

Remember: never negotiate down from MSRP — always negotiate up from the new car invoice price! Check out mycardiscount.com for the best new car invoice price available.

0no comments yet