When to Use Black Latex Disposable Gloves

31 de Março de 2025, 8:34 - sem comentários aindaBlack latex disposable gloves are an significantly popular selection because of their flexibility, toughness, and trendy appearance. Whether for professional or particular use, these gloves offer excellent protection and are suited to a wide variety of industries and tasks. Here's a glance at some of the most popular purposes for black latex gloves.

1. Food Preparation and Handling

In regards to food security, Black latex gloves are an addition in lots of professional kitchens, food trucks, and catering services. Their warm fit assures no pollutants move from the handler to the food, sustaining health standards. Additionally, their Black color is successfully interesting and helps hide stains, creating them well suited for high-visibility circumstances like start kitchen environments or food demonstrations.

2. Tattoo and Sharp Studios

Tattoo artists and piercers require exemplary detail and sanitation when performing their craft. Black latex gloves are a well liked in these controls not merely because of their skilled aesthetic but in addition due to their exceptional responsive sensitivity. This ensures artists can keep control over their tools while sticking with rigid hygiene regulations.

3. Salon and Elegance Companies

Whether dyeing hair, using phony tan, or performing face remedies, salon professionals count on Black latex gloves due to their toughness and resistance to chemicals. These gloves keep hands safe from harsh dyes, bleaches, and other salon compounds while projecting a sleek and finished picture for customers to see.

4. Automotive and Physical Function

Black latex gloves certainly are a go-to for anyone in the automotive and physical industries. Employees handle oil, gas, and different dirty ingredients daily, so durable gloves are necessary for protecting their hands and sustaining clean perform surfaces. The Black coloration also makes spots and dust less obvious, offering a solution look all through client interactions.

5. Lab and Clinical Settings

Laboratory specialists and scientists usually use Black latex gloves for tasks that demand precision and protection. Their opposition to chemicals and comfortable match make them exemplary for handling research gear and completing experiments without diminishing safety.

6. Washing and Janitorial Perform

Cleaning professionals often choose Black latex gloves for heavy-duty cleaning jobs. They protect arms from contact with hard cleaning agents and reduce the chances of epidermis irritation. Plus, their black shade assists hide dirt and dust, making them a great choice for public or prestigious properties.

7. Home Projects

Black latex gloves may also be widely employed for particular jobs at home. Whether garden, painting, or correcting appliances, they provide an inexpensive, reliable answer to guard the hands and make cleaning easier.

From medical to industrial applications, Black latex gloves have solidified their position as a dependable instrument for an array of purposes. Their mix of functionality and beauty ensures they are well-suited for equally professional and personal use. Regardless of the task, Black latex gloves offer an unmatched mix of fashion, protection, and practicality.

How to Maximize Your Rental Property Tax Deductions

31 de Março de 2025, 6:19 - sem comentários aindaHaving a rental property could be financially worthwhile, but maximizing your duty deductions is essential to take advantage of your investment. Knowledge the many expenses you can state won't just allow you to cut costs but in addition guarantee you're complying with tax laws. Here's a brief manual on how best to maximize your how much does a property manager cost effectively.

Keep Monitoring of Operating Expenses

Running expenses would be the continuing costs of working your rental property, and they could accumulate quickly. These are fully deductible and may contain things like home management charges, promotion costs for attracting tenants, cleaning services, and schedule home maintenance. For example, if you spend $1,000 annually on preservation, checking and declaring that expense could help you save a substantial volume in taxes. Keep all invoices and bills for appropriate documentation.

Withhold Mortgage Interest and Insurance Premiums

One of the very considerable expenses hire home owners experience could be the mortgage, but the good news could be the interest section is deductible. As an example, if you paid $10,000 in mortgage curiosity a year ago, you can declare that to somewhat decrease your taxable income. Equally, do not neglect insurance premiums particular to your hire property. Whether it's homeowner's insurance or responsibility coverage, these expenses are completely deductible.

Do not Skip On Depreciation

Depreciation is a duty benefit several home owners fail to leverage. The IRS enables you to take the continuous loss in price of your rental home over 27.5 decades (for residential properties). For instance, if your home is worth $275,000, you could state about $10,000 annually as a depreciation expense. This reduction can be quite a substantial gain, particularly since it does not include an out-of-pocket cost.

Claim Repairs and Improvements Separately

It's essential to differentiate between fixes and money changes when claiming deductions. Fixes, such as solving a leaky sink or repairing a broken screen, are fully deductible in the season incurred. On the other give, bigger improvements like renovating a bathroom or adding a brand new ceiling should be capitalized and depreciated around a few years. Maintaining clean documents will help you categorize these costs correctly.

Travel-Related Expenses

If you go and from your own hire house for inspections, fixes, or any other connected responsibilities, these travel expenses can be deducted. Car usage, airfare, and lodging (if necessary) are respectable deductions. To keep certified, keep an in depth wood of journey days, locations, and purposes.

Keep Arranged and Find Skilled Guidance

Maximizing your deductions needs organization. Use accounting application or maintain comprehensive spreadsheets to track your money and costs throughout the year. Duty regulations modify usually, therefore consulting an expert may assure you're benefiting from all available deductions while preventing expensive errors.

By proactively handling these tax deductions, rental home owners may considerably raise their get back on expense and reduce taxable income. Keep diligent documents and keep up to date with new rules to maximize your benefits.

Top Tax Deductions Every Short Term Rental Host Should Know

31 de Março de 2025, 5:01 - sem comentários aindaMoving tax period can be quite a challenge, especially for short-term hire hosts trying to decrease their duty burden while keeping compliant. Processing tax deductions for short-term rentals is sold with opportunities to save lots of, but small mistakes may cost you time, money, and actually trigger audits. Here are a few common problems to prevent when filing your airbnb tax deductions.

1. Misclassifying Your House

One of the very substantial problems hosts make isn't correctly classifying their hire property. Can it be considered rental home, or can it be an additional home or main house? Tax principles range centered on classification, often established by the amount of personal times versus hire days. If the house was leased for less than 14 times in a year, you may not owe fees on the hire income, but deductions might not apply.

2. Overlooking Depreciation Deductions

Depreciation is one of the very important deductions for hire house owners, yet it is usually overlooked. The IRS enables you to deduct the depreciation of your home around 27.5 years when it qualifies as a rental. Many owners don't take advantage of this, causing substantial deductions unclaimed. Assure you are calculating depreciation correctly on the basis of the property's value (excluding land).

3. Pairing Personal and Rental Costs

Still another frequent error is failing to split up personal expenses from hire expenses. If you use your house for private applications and for hosting short-term rentals, you are able to only take the portion of expenses related to hire use. For instance, resources and maintenance expenses should be prorated on the basis of the percentage of hire use. Avoid the mistake of deducting 100% of distributed expenses when particular use is involved.

4. Forgetting to Monitor All Suitable Costs

Short-term hire hosts usually underestimate their deductions by failing continually to track all suitable expenses. Deductible expenses can contain home management charges, marketing charges, washing companies, insurance, mortgage interest, and even repairs. Sustaining detail by detail files of each price assures you don't overlook potential savings.

5. Misreporting Hire Income

Every buck earned from short-term rentals should be noted precisely to prevent penalties. Many hosts neglect money obtained from third-party systems, security remains kept as revenue, and additional fees. Ensure that your income statements reconcile with earnings noted by booking programs to avoid differences that can increase red banners with the IRS.

6. Not Visiting a Tax Qualified

Wanting to undertake short-term hire fees without expert advice can lead to missed deductions or errors. Duty regulations related to short-term rentals may differ by jurisdiction and are often updated. A competent duty qualified knowledgeable about rental attributes can assist you to improve deductions and avoid errors.

Avoiding these mistakes is key to minimizing duty responsibility while remaining compliant. By keeping detailed records, knowledge IRS principles, and seeking qualified advice when needed, short-term hire hosts can save yourself time, reduce expensive problems, and take advantage of these tax deductions.

How to Choose the Best SEO Plugin for WordPress

31 de Março de 2025, 3:47 - sem comentários ainda

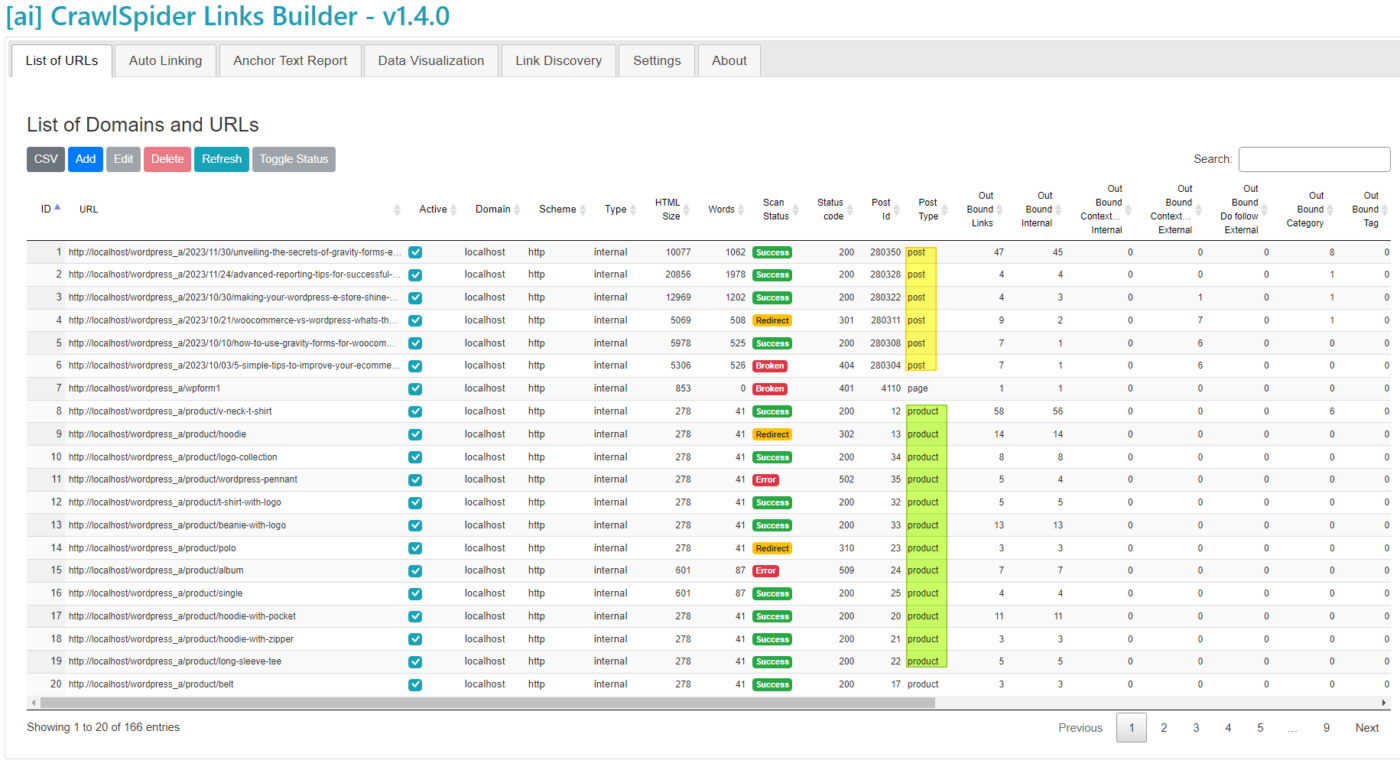

If you're managing a WordPress website, internet search engine optimization (SEO) is vital for improving your exposure and operating organic traffic. Among the best ways to streamline your SEO efforts is by utilizing an internal links for seo.But with therefore many accessible, how will you decide what type is proper for your requirements? Here is a concise manual to assist you produce the very best choice.

1. Understand Your SEO Needs

Before choosing an SEO plugin, you will need to understand your website's specific requirements. Are you currently trying to find fundamental SEO aid, like controlling meta labels and optimizing keywords, or do you really need advanced functionalities like schema markup, backlink evaluation, or regional SEO methods? Answering this issue can help narrow down your options.

As an example, if you are handling a website or little site, a simple plugin like All inOne SEO Group can meet your needs. For better quality tasks, Yoast SEO or Position Qmay be considered a better fit.

2. Look for User-Friendliness

An user-friendly and easy-to-navigate program is critical, especially if you're no SEO expert. An excellent SEO plugin should simplify complicated tasks, such as creating XML sitemaps, determining readability issues, and introducing meta descriptions. Search for jacks offering obvious directions, guided setup processes, or beginner-friendly modes.

Common extensions like Yoast SEO and SEOPress are known for their user-friendly layouts and integral manuals which make SEO more approachable.

3. Consider Advanced Features

Not all SEO plugins are manufactured equal. The very best plugin provides features that align with your goals. Types of must-have advanced features contain:

Material Evaluation for on-page optimization.

Keyword Tracking to monitor rankings.

Schema Markup for rich snippet integration.

Redirect Supervisor to repair broken links and redirect pages.

Plug-ins such as for instance Position Q often stick out due to their detailed pair of sophisticated features, creating them great for rising websites.

4. Check for Compatibility

Whenever choosing an SEO plugin, it's essential to examine their compatibility along with your WordPress topic and different plugins. Regular situations can disturb your website's performance, so decide for well-maintained jacks with exceptional opinions and active support.

5. Review Cost and Support

While free SEO plugins provide simple services, premium jacks usually give remarkable functions and support. Assess your allowance and select a plugin that delivers value for money. And generally pick a plugin with active customer service, lessons, and a helpful community.

Final Thoughts

The proper SEO plugin depends on your particular needs, level of experience, and budget. Remember to examine choices like Yoast SEO, Position Q, and SEOPress on the basis of the criteria above. With the right plugin, you'll successfully handle your SEO initiatives and make fully sure your WordPress website is properly optimized for search motors!